Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers

Related Articles: Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers

- 2 Introduction

- 3 Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers

- 3.1 Understanding the Basics of Federal Payroll

- 3.2 Key Considerations for the 2025 Federal Payroll Calendar

- 3.3 Benefits of Using a Federal Payroll Calendar

- 3.4 Navigating the 2025 Calendar: Key Dates and Deadlines

- 3.5 Frequently Asked Questions (FAQs) About the 2025 Federal Payroll Calendar

- 3.6 Conclusion: The Importance of Effective Payroll Management

- 4 Closure

Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers

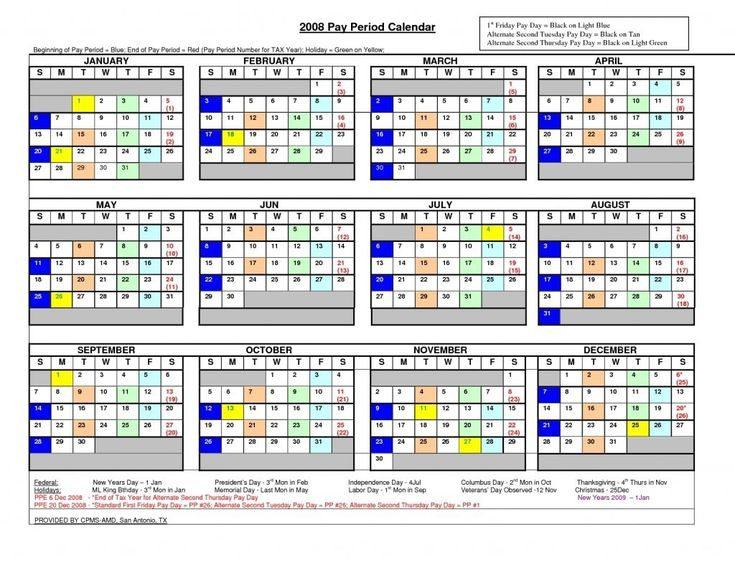

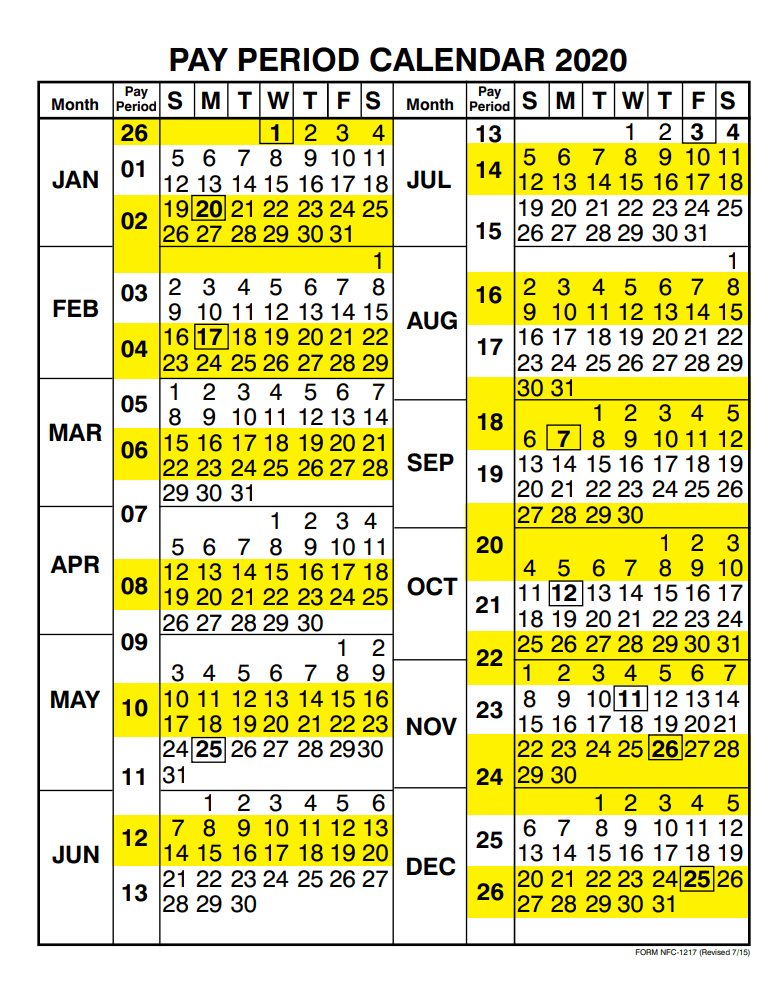

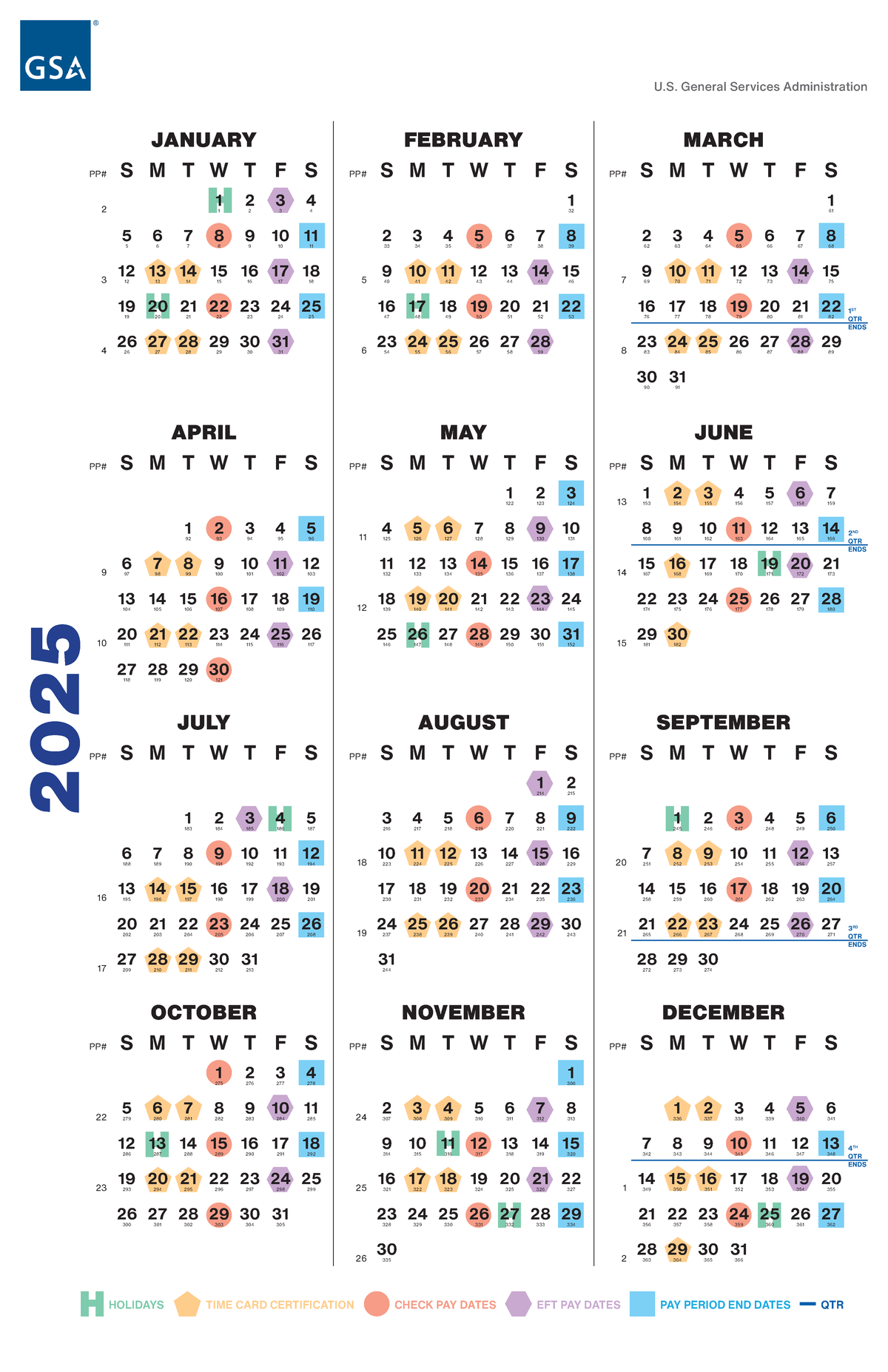

The federal payroll calendar is a critical tool for employers, providing a clear roadmap for navigating payroll obligations and deadlines throughout the year. This calendar outlines key dates for federal tax withholdings, payments, and reporting requirements, ensuring compliance and avoiding potential penalties. While the 2025 calendar is not yet finalized, understanding the general framework and key considerations will empower employers to prepare effectively.

Understanding the Basics of Federal Payroll

Before delving into the specifics of the 2025 calendar, it’s essential to grasp the fundamentals of federal payroll. This involves understanding:

- Federal Income Tax Withholding: This is the amount of tax withheld from employee wages and salaries to cover their federal income tax liability. The amount withheld is based on factors like the employee’s filing status, income level, and claimed deductions.

- Social Security and Medicare Taxes: These are mandatory taxes levied on both employers and employees to fund Social Security and Medicare programs.

- Payroll Taxes: This encompasses all taxes related to payroll, including federal income tax, Social Security and Medicare taxes, and unemployment taxes.

- Payroll Reporting: Employers are required to file various reports with the Internal Revenue Service (IRS) to document payroll tax payments and withholdings. These reports include Form 941 (Employer’s Quarterly Federal Tax Return) and Form W-2 (Wage and Tax Statement) for each employee.

Key Considerations for the 2025 Federal Payroll Calendar

While the specific dates for 2025 are subject to change, some overarching principles remain consistent:

- Quarterly Tax Payments: Employers typically make quarterly payments of federal income tax, Social Security, and Medicare taxes. These payments are due on specific dates, usually the 15th of April, June, September, and January.

- Annual Reporting: Employers must file annual reports, including Form W-2 and Form 1099, summarizing employee wages and tax withholdings. These reports are due by January 31st of the following year.

- Tax Year End: The federal tax year runs from January 1st to December 31st. This means that all payroll activities related to a particular year must be finalized by the end of December.

Benefits of Using a Federal Payroll Calendar

Utilizing a federal payroll calendar offers numerous benefits for employers:

- Reduced Risk of Penalties: By adhering to deadlines and complying with regulations, employers minimize the risk of penalties and fines for late payments or incorrect reporting.

- Improved Efficiency: A clear calendar helps streamline payroll processes, allowing for efficient planning and execution.

- Enhanced Accuracy: By staying organized and tracking deadlines, employers can reduce the likelihood of errors in tax withholdings and reporting.

- Increased Compliance: The calendar serves as a guide for staying compliant with federal tax laws and regulations.

Navigating the 2025 Calendar: Key Dates and Deadlines

While the precise dates for the 2025 federal payroll calendar are not yet available, it’s crucial to understand the general framework and key deadlines.

Quarterly Tax Payments:

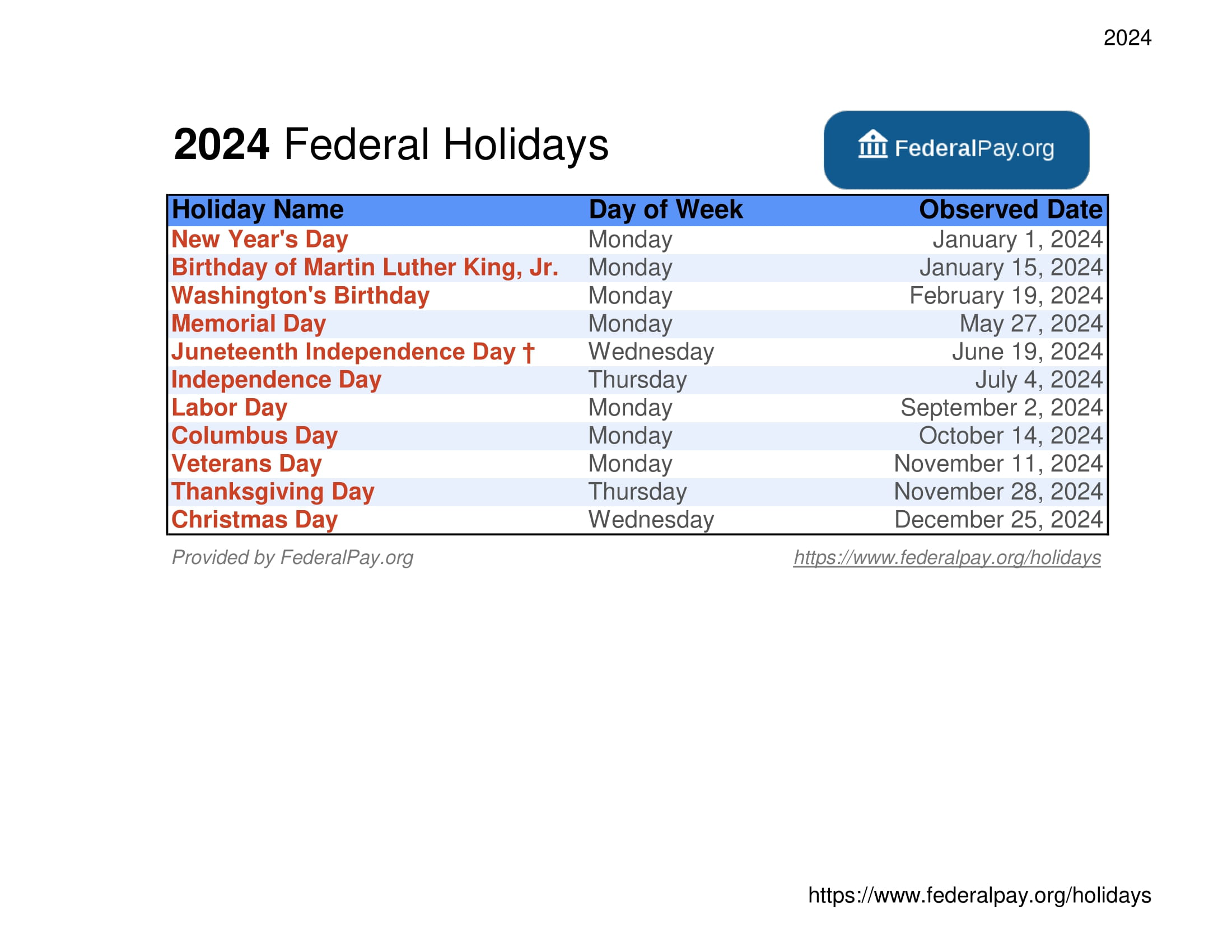

- First Quarter: Typically due April 15th (unless it falls on a weekend or holiday, in which case it may be extended to the next business day).

- Second Quarter: Typically due June 15th (unless it falls on a weekend or holiday, in which case it may be extended to the next business day).

- Third Quarter: Typically due September 15th (unless it falls on a weekend or holiday, in which case it may be extended to the next business day).

- Fourth Quarter: Typically due January 15th of the following year (unless it falls on a weekend or holiday, in which case it may be extended to the next business day).

Annual Reporting:

- Form W-2: Due January 31st of the following year.

- Form 1099: Due January 31st of the following year.

Other Important Dates:

- Tax Year End: December 31st.

- IRS Filing Season: Typically opens in late January and closes in mid-April.

Frequently Asked Questions (FAQs) About the 2025 Federal Payroll Calendar

Q: Where can I find the official 2025 federal payroll calendar?

A: The official calendar is usually published by the IRS in the latter part of the previous year. You can access it on the IRS website or through reputable payroll software providers.

Q: What if a deadline falls on a weekend or holiday?

A: If a deadline falls on a weekend or holiday, it is generally extended to the next business day. However, it’s always best to consult the official IRS calendar for confirmation.

Q: What happens if I miss a deadline?

A: Missing a deadline can result in penalties and fines. The severity of the penalty depends on the nature of the missed deadline and the amount of tax owed.

Q: Can I use a payroll software program to manage my federal payroll obligations?

A: Yes, many payroll software programs are designed to help employers manage federal payroll requirements, including calculating withholdings, filing reports, and making payments. These programs can significantly simplify the process and reduce the risk of errors.

Q: What are some tips for staying compliant with federal payroll regulations?

A: Here are some tips for staying compliant with federal payroll regulations:

- Stay Informed: Regularly update yourself on changes to federal tax laws and regulations. Subscribe to IRS newsletters or follow reputable payroll resources.

- Use Reliable Resources: Consult with tax professionals or payroll experts for guidance on complex matters.

- Maintain Accurate Records: Keep thorough and accurate records of all payroll transactions, including employee information, wages, withholdings, and payments.

- Utilize Technology: Employ payroll software programs or other technology tools to automate tasks and ensure accuracy.

- Seek Professional Help: If you’re unsure about any aspect of federal payroll, consult with a qualified tax advisor or payroll specialist.

Conclusion: The Importance of Effective Payroll Management

The federal payroll calendar is a crucial tool for employers, providing a roadmap for navigating complex payroll obligations and deadlines. Understanding the calendar’s framework, key dates, and reporting requirements empowers employers to ensure compliance, minimize penalties, and maintain a smooth payroll operation. By staying informed, utilizing reliable resources, and seeking professional assistance when needed, employers can effectively manage their federal payroll obligations and focus on their core business operations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Federal Payroll Calendar: A Comprehensive Guide for Employers. We hope you find this article informative and beneficial. See you in our next article!