Navigating the Canadian Economic Landscape: Understanding the Economic Calendar

Related Articles: Navigating the Canadian Economic Landscape: Understanding the Economic Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Canadian Economic Landscape: Understanding the Economic Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Canadian Economic Landscape: Understanding the Economic Calendar

- 2 Introduction

- 3 Navigating the Canadian Economic Landscape: Understanding the Economic Calendar

- 3.1 Deciphering the Calendar: Key Economic Indicators

- 3.2 The Significance of the Economic Calendar: A Powerful Tool for Informed Decision-Making

- 3.3 Navigating the Economic Calendar: Tips for Effective Utilization

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Conclusion

- 4 Closure

Navigating the Canadian Economic Landscape: Understanding the Economic Calendar

The Canadian economy, like any other, is a dynamic entity influenced by a myriad of factors. To comprehend its intricate workings and anticipate potential shifts, investors, analysts, and policymakers rely on a crucial tool: the Canadian Economic Calendar. This comprehensive resource provides a detailed schedule of upcoming economic releases, offering insights into the health and direction of the Canadian economy.

Deciphering the Calendar: Key Economic Indicators

The Economic Calendar is populated with a diverse array of economic indicators, each offering a distinct perspective on the state of the Canadian economy. These indicators can be broadly categorized into:

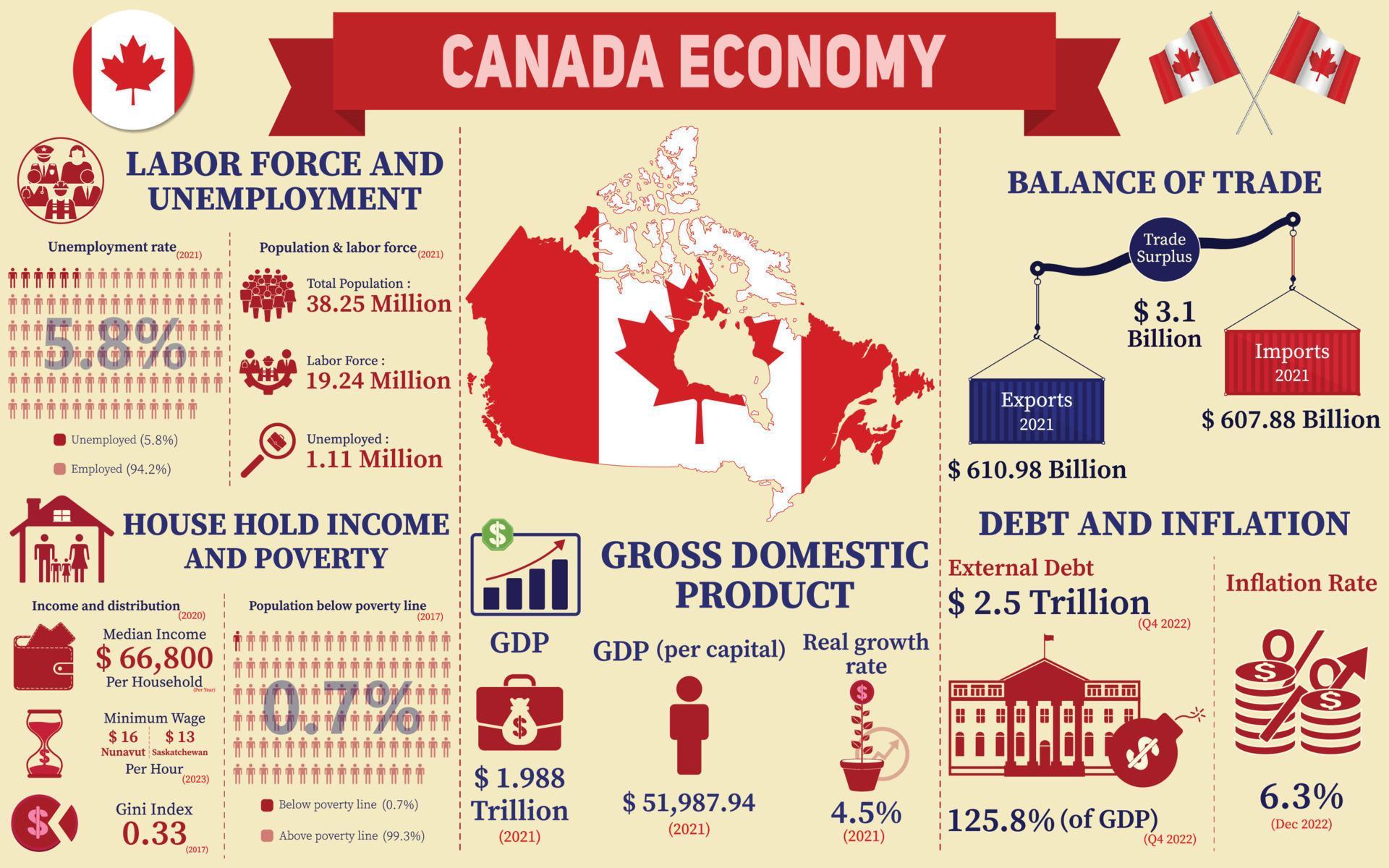

1. Macroeconomic Indicators: These indicators provide a broad overview of the overall economy’s performance. Examples include:

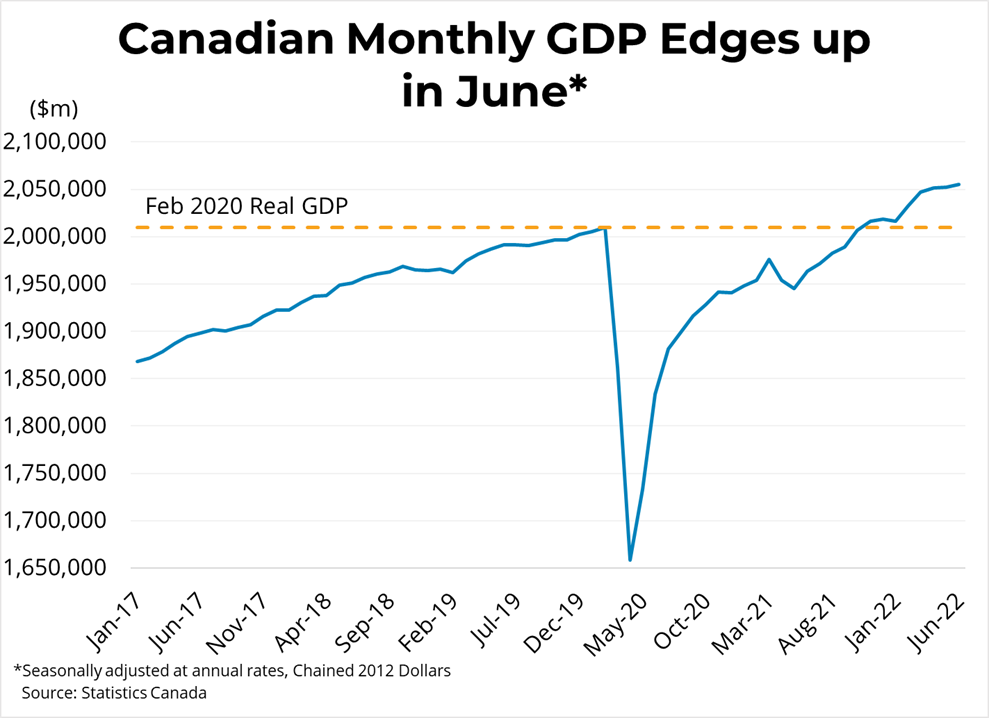

- Gross Domestic Product (GDP): The most comprehensive measure of economic activity, reflecting the total value of goods and services produced within the country.

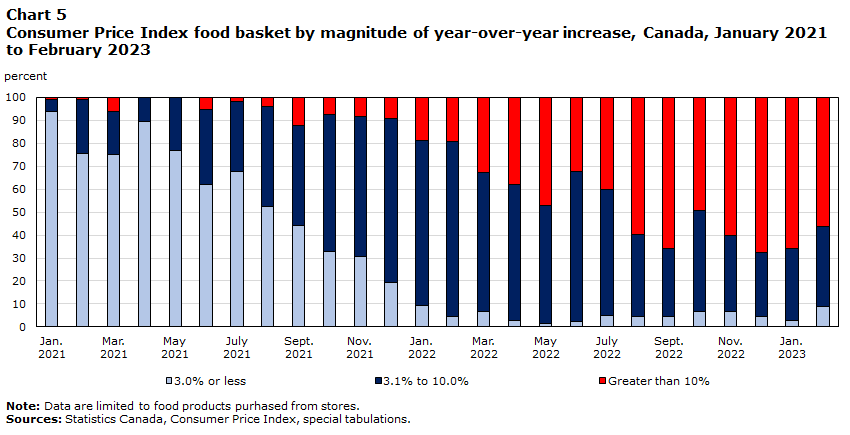

- Inflation Rate: A measure of the rate at which prices for goods and services rise over time, indicating purchasing power erosion.

- Unemployment Rate: The percentage of the labor force that is actively seeking employment but remains unemployed.

- Consumer Price Index (CPI): Tracks the average change in prices paid by urban consumers for a basket of consumer goods and services.

- Trade Balance: Represents the difference between the value of exports and imports, revealing a country’s trade competitiveness.

2. Monetary Policy Indicators: These indicators provide insights into the Bank of Canada’s actions and their potential impact on the economy. Examples include:

- Interest Rate Decisions: The Bank of Canada’s policy rate, adjusted to influence economic growth and inflation.

- Monetary Policy Report: A comprehensive document outlining the Bank of Canada’s assessment of the economy and its future policy direction.

3. Financial Market Indicators: These indicators provide information about the performance of the Canadian financial markets. Examples include:

- Stock Market Indices: Measures of the overall performance of the Canadian stock market, such as the S&P/TSX Composite Index.

- Bond Yields: Reflects the interest rates investors demand for lending money to the government or corporations.

- Exchange Rates: The value of the Canadian dollar against other currencies, impacting trade and investment flows.

The Significance of the Economic Calendar: A Powerful Tool for Informed Decision-Making

The Canadian Economic Calendar serves as an invaluable resource for various stakeholders:

1. Investors: By monitoring key economic indicators, investors can gain insights into potential market trends, helping them make informed investment decisions. For example, a strong GDP report might signal a positive outlook for the stock market, while rising inflation could lead to increased interest rates, potentially impacting bond yields.

2. Analysts: Economists and market analysts rely on the Economic Calendar to track economic performance, formulate forecasts, and identify potential risks and opportunities. They use this data to generate research reports, providing valuable insights to investors and policymakers.

3. Policymakers: The Bank of Canada and the Canadian government utilize the Economic Calendar to monitor the economy’s health and adjust policies accordingly. For instance, a surge in inflation might prompt the Bank of Canada to raise interest rates to curb price increases.

4. Businesses: Companies can leverage the Economic Calendar to assess the economic climate and make informed decisions about pricing, investment, and hiring. For example, a strong consumer confidence index might indicate a favorable environment for expanding operations.

Navigating the Economic Calendar: Tips for Effective Utilization

1. Focus on Key Indicators: Prioritize the most relevant economic indicators for your specific needs. For instance, investors may focus on inflation and interest rate decisions, while businesses might pay closer attention to consumer spending and manufacturing output.

2. Understand the Release Schedule: Familiarise yourself with the frequency of economic releases. Some indicators are released monthly (e.g., GDP), while others are quarterly (e.g., inflation).

3. Analyze the Data: Don’t simply look at the headline numbers; delve into the details of the data release. Consider the underlying factors contributing to the results and their potential impact on the economy.

4. Monitor Market Reactions: Observe how financial markets react to economic releases. A strong economic report may lead to a stock market rally, while weak data could trigger a sell-off.

5. Stay Informed: Keep abreast of economic news and commentary from reputable sources to gain a comprehensive understanding of the economic landscape.

Frequently Asked Questions (FAQs)

1. Where can I find the Canadian Economic Calendar?

Several reputable websites offer comprehensive Canadian Economic Calendars, including:

- Bank of Canada: https://www.bankofcanada.ca/

- Trading Economics: https://tradingeconomics.com/canada/calendar

- Investing.com: https://www.investing.com/economic-calendar/

2. What time are economic releases typically announced?

Economic releases are typically announced during the Eastern Time (ET) zone. However, it’s essential to check the specific release times on the Economic Calendar, as they can vary.

3. How can I interpret economic data?

Understanding the context surrounding an economic release is crucial. Consider factors like:

- Previous releases: Compare the current data with previous releases to identify trends.

- Market expectations: Analyze how the actual data compares to market expectations, which can influence market reactions.

- Underlying factors: Identify the key factors driving the economic indicator, such as consumer spending, government policies, or global events.

4. Can the Economic Calendar predict the future?

While the Economic Calendar provides valuable insights into the current economic climate, it cannot predict the future with certainty. Economic data is subject to various factors, and unforeseen events can significantly impact the economy.

5. How can I use the Economic Calendar for personal finance?

The Economic Calendar can inform your personal financial decisions by:

- Understanding interest rate trends: Monitor interest rate decisions to anticipate potential changes in mortgage rates or savings account interest rates.

- Assessing inflation: Track inflation to make informed decisions about spending and saving.

- Evaluating investment opportunities: Identify potential investment opportunities based on economic indicators, such as strong GDP growth or a favorable trade balance.

Conclusion

The Canadian Economic Calendar is a vital tool for navigating the complex world of Canadian economics. By understanding the key economic indicators and their significance, investors, analysts, policymakers, and businesses can gain valuable insights into the health and direction of the economy. Utilizing the Economic Calendar effectively can empower informed decision-making, leading to better investment outcomes, informed policy strategies, and successful business operations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Canadian Economic Landscape: Understanding the Economic Calendar. We appreciate your attention to our article. See you in our next article!