Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar

Related Articles: Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar

- 2 Introduction

- 3 Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar

- 3.1 Decoding the Economic Calendar: Key Components and Their Significance

- 3.2 The Importance of Understanding the Financial Calendar

- 3.3 FAQs Regarding the 2025 Financial Calendar

- 3.4 Tips for Effectively Utilizing the 2025 Financial Calendar

- 3.5 Conclusion: Navigating the Financial Landscape with Informed Decisions

- 4 Closure

Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar

The financial calendar for 2025, much like its predecessors, holds the potential to be a powerful tool for investors, traders, and economic analysts alike. It serves as a roadmap, outlining key economic events and data releases that can significantly impact market movements and investment decisions. This comprehensive calendar provides a structured framework for understanding the ebb and flow of the global economy, allowing for informed and strategic financial planning.

Decoding the Economic Calendar: Key Components and Their Significance

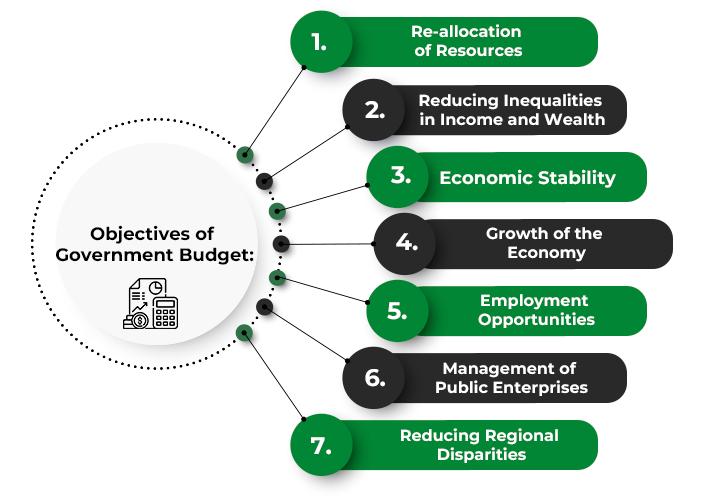

The 2025 financial calendar is a dynamic document, constantly updated to reflect the evolving economic landscape. It typically encompasses a diverse range of events, each carrying its own unique weight and implications for the financial markets. These events can be broadly categorized into:

1. Central Bank Meetings and Interest Rate Decisions:

Central banks, such as the Federal Reserve in the United States and the European Central Bank, play a pivotal role in shaping economic conditions by setting interest rates and influencing monetary policy. Their meetings, where interest rate decisions are announced, are closely watched by investors as these announcements can significantly impact market sentiment and asset prices.

- Impact: Interest rate hikes can lead to a tightening of monetary policy, potentially slowing down economic growth and impacting the value of equities. Conversely, interest rate cuts can stimulate economic activity, potentially boosting equity markets.

2. Economic Data Releases:

Regularly released economic data, such as GDP growth, inflation rates, unemployment figures, and manufacturing indices, provide valuable insights into the health and direction of the economy. These data points can influence investor expectations and market sentiment.

- Impact: Positive economic data releases, such as a strong GDP growth report, can boost investor confidence and lead to higher stock prices. Conversely, negative economic data, like a rise in unemployment, can trigger market sell-offs.

3. Government Policy Announcements:

Government policy announcements, such as budget updates, tax changes, and trade agreements, can have significant ramifications for businesses and investors. These announcements often reflect the government’s economic priorities and can influence market direction.

- Impact: Policy announcements that promote economic growth and business investment can lead to a positive market reaction. Conversely, policies that stifle economic activity or increase uncertainty can negatively impact market sentiment.

4. Corporate Earnings Reports:

Quarterly earnings reports released by publicly traded companies offer insights into their financial performance and future prospects. These reports can be crucial for investors making decisions on stock purchases or sales.

- Impact: Companies that exceed earnings expectations typically see their stock prices rise, while those that miss expectations may experience declines.

The Importance of Understanding the Financial Calendar

The 2025 financial calendar serves as an essential tool for financial decision-making, offering several key benefits:

- Forecasting Market Movements: By understanding upcoming events and their potential impact, investors can anticipate market trends and adjust their investment strategies accordingly.

- Identifying Opportunities: The calendar can highlight periods of potential volatility, providing opportunities for traders to capitalize on market fluctuations.

- Mitigating Risk: By understanding the potential risks associated with upcoming events, investors can make informed decisions to protect their portfolios.

- Improving Investment Strategy: The calendar provides a structured framework for analyzing economic data and assessing market sentiment, ultimately leading to more informed investment decisions.

FAQs Regarding the 2025 Financial Calendar

1. How can I access the 2025 financial calendar?

Numerous online platforms, financial news websites, and investment research firms offer access to comprehensive financial calendars. Many of these resources provide customizable calendars allowing users to filter events by region, asset class, or specific data points.

2. What is the best way to utilize the financial calendar for investment decisions?

The best approach is to use the calendar in conjunction with other fundamental and technical analysis tools. It is crucial to understand the context of each event, its potential impact on the market, and how it aligns with your investment objectives.

3. How often is the financial calendar updated?

Financial calendars are typically updated on a regular basis, often daily or weekly, to reflect changes in economic conditions and scheduled events.

4. Are there any specific events on the 2025 calendar that are particularly important to watch?

The importance of specific events can vary depending on individual investment strategies and market conditions. However, some events that are generally considered significant include central bank meetings, key economic data releases, and major government policy announcements.

5. Is the financial calendar a foolproof guide for investment decisions?

The financial calendar provides valuable information, but it is essential to remember that it is not a crystal ball. Market movements can be influenced by a multitude of factors, and unexpected events can occur, leading to market volatility. Therefore, it is crucial to use the calendar as a guide and not solely rely on it for investment decisions.

Tips for Effectively Utilizing the 2025 Financial Calendar

- Stay Updated: Regularly check the calendar for updates and changes to scheduled events.

- Customize Your Calendar: Filter events by region, asset class, or specific data points to focus on areas relevant to your investment strategy.

- Analyze the Context: Consider the economic backdrop and market sentiment when interpreting the potential impact of events.

- Use Multiple Sources: Compare different financial calendars and consult with financial professionals for additional insights.

- Combine with Other Tools: Integrate the calendar with other analysis tools, such as fundamental and technical analysis, for a comprehensive understanding of market trends.

Conclusion: Navigating the Financial Landscape with Informed Decisions

The 2025 financial calendar serves as a powerful tool for navigating the complex and dynamic world of finance. By understanding the key events, their potential impact, and how to utilize this information effectively, investors can make more informed decisions, potentially improving their investment outcomes. However, it is crucial to remember that the financial calendar is just one piece of the puzzle. Combining it with other analysis tools, staying updated on market developments, and seeking professional advice can ultimately lead to a more comprehensive and strategic approach to financial planning.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: Understanding the Significance of the 2025 Economic Calendar. We thank you for taking the time to read this article. See you in our next article!