Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar

Related Articles: Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar

- 2 Introduction

- 3 Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar

- 3.1 Defining the Fiscal Calendar

- 3.2 Key Elements of the 2025 Fiscal Calendar

- 3.3 Importance and Benefits of Understanding the 2025 Fiscal Calendar

- 3.4 FAQs: Navigating the 2025 Fiscal Calendar

- 3.5 Tips for Navigating the 2025 Fiscal Calendar

- 3.6 Conclusion: The Importance of a Comprehensive Understanding

- 4 Closure

Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar

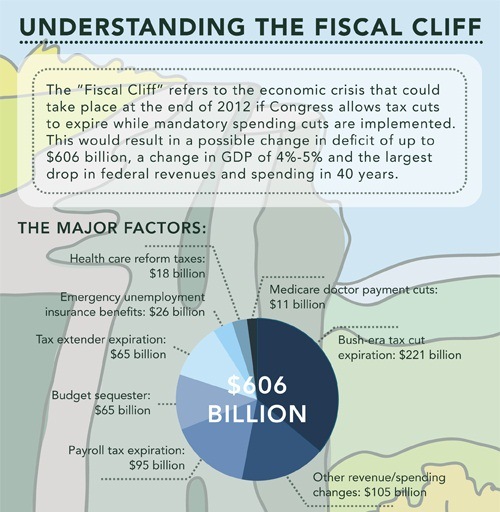

The fiscal calendar, a framework for managing government finances, plays a crucial role in shaping economic policy and guiding budgetary decisions. Understanding the 2025 fiscal calendar is essential for businesses, investors, and individuals alike, as it provides valuable insights into government spending, tax policies, and potential economic impacts.

Defining the Fiscal Calendar

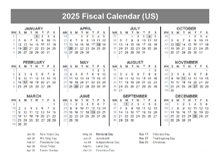

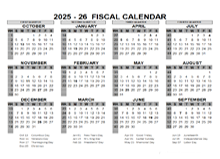

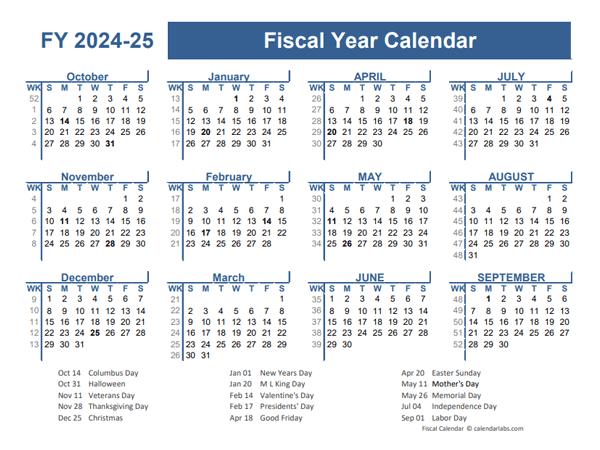

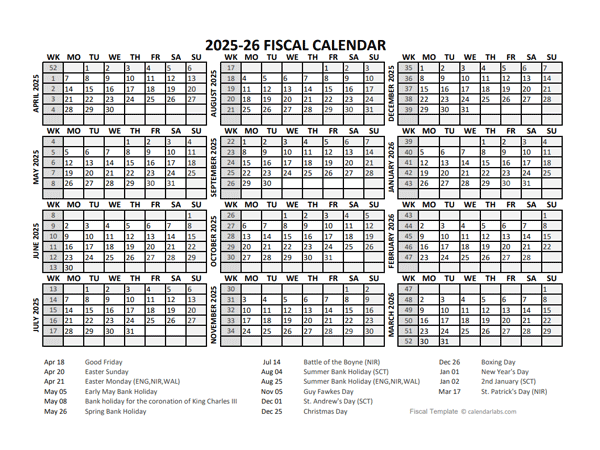

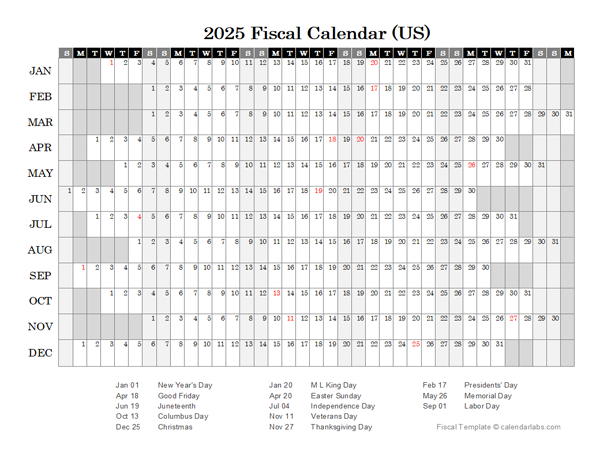

The fiscal calendar, unlike the traditional calendar year, defines a specific period for government budgeting and financial operations. Most countries, including the United States, operate on a fiscal year that runs from October 1st to September 30th of the following year. This means that the 2025 fiscal year encompasses the period from October 1st, 2024, to September 30th, 2025.

Key Elements of the 2025 Fiscal Calendar

The 2025 fiscal calendar encompasses a series of crucial events and deadlines that influence government finances and economic activity. Understanding these key elements is vital for navigating the fiscal landscape:

1. Budget Formulation and Approval: The fiscal year begins with the formulation of the budget, a detailed plan outlining government revenue and expenditure for the upcoming year. This process involves extensive consultations with various stakeholders, including government agencies, industry representatives, and economists. The budget proposal is then presented to the legislature for approval, which typically involves debates and amendments before finalization.

2. Tax Filing Deadlines: The fiscal calendar dictates tax filing deadlines for individuals and businesses. These deadlines vary depending on the jurisdiction, but they generally fall within the fiscal year. Understanding these deadlines is crucial for ensuring compliance with tax regulations and avoiding penalties.

3. Government Spending and Investment: Government spending is a key driver of economic activity. The 2025 fiscal calendar will reveal government allocations for various sectors, including infrastructure, education, healthcare, and defense. These allocations influence economic growth, job creation, and overall economic stability.

4. Fiscal Policy Adjustments: The fiscal calendar allows for adjustments to fiscal policies throughout the year. These adjustments can involve changes in tax rates, government spending levels, or other measures aimed at influencing economic conditions. Understanding these policy shifts is essential for businesses and investors, as they can impact market dynamics and investment decisions.

Importance and Benefits of Understanding the 2025 Fiscal Calendar

Understanding the 2025 fiscal calendar offers numerous benefits for various stakeholders:

For Businesses:

- Predicting Market Trends: By analyzing government spending plans and tax policies, businesses can anticipate potential changes in demand, supply, and competition. This knowledge allows for informed strategic planning and decision-making.

- Optimizing Financial Strategies: Understanding tax deadlines and potential policy changes enables businesses to optimize their financial strategies, including investment decisions, tax planning, and resource allocation.

- Navigating Regulatory Changes: The fiscal calendar often includes updates to regulations affecting businesses. Staying informed about these changes allows businesses to ensure compliance and avoid potential legal issues.

For Investors:

- Assessing Investment Opportunities: Understanding government spending priorities and fiscal policies provides investors with valuable insights into potential investment opportunities. For example, increased infrastructure spending could create opportunities in construction and related industries.

- Managing Risk: Awareness of potential fiscal policy changes allows investors to manage risk effectively. Understanding potential tax hikes or spending cuts can inform investment decisions and portfolio diversification strategies.

- Understanding Economic Outlook: The fiscal calendar provides a roadmap for understanding the government’s economic outlook and policy response. This knowledge helps investors make informed decisions about asset allocation and risk management.

For Individuals:

- Planning for Tax Obligations: Understanding tax deadlines and potential policy changes empowers individuals to plan their tax obligations effectively. This includes strategies for maximizing deductions, minimizing tax liability, and ensuring timely filing.

- Making Informed Financial Decisions: The fiscal calendar provides insights into government spending priorities and potential economic impacts. This knowledge can guide individuals in making informed financial decisions, such as saving, investing, and spending.

- Understanding Government Policies: The fiscal calendar sheds light on government policies that directly affect individuals, including healthcare, education, and social welfare programs. This understanding helps individuals navigate the complexities of government programs and advocate for their interests.

FAQs: Navigating the 2025 Fiscal Calendar

Q: What are the key dates to watch out for in the 2025 fiscal calendar?

A: The key dates vary depending on the specific jurisdiction. However, some common dates include:

- Budget Presentation: The date when the government presents its budget proposal to the legislature.

- Budget Approval: The date when the legislature approves the final budget.

- Tax Filing Deadlines: The deadlines for individuals and businesses to file their tax returns.

- Government Spending Announcements: Dates when the government announces specific spending allocations for various sectors.

- Fiscal Policy Adjustments: Dates when the government announces changes to tax policies or spending levels.

Q: How can I stay informed about the 2025 fiscal calendar?

A: Staying informed about the 2025 fiscal calendar is crucial for making informed decisions. Here are some resources:

- Government Websites: The official websites of government agencies, such as the Treasury Department or Ministry of Finance, provide updates on budget proposals, tax policies, and spending plans.

- Financial News Outlets: Major financial news outlets, such as Bloomberg, Reuters, and The Wall Street Journal, provide comprehensive coverage of fiscal developments and their economic implications.

- Industry Associations: Industry associations often provide analysis and insights specific to their sectors, highlighting the impact of fiscal policies on their members.

- Economic Research Institutes: Independent research institutions, such as the Congressional Budget Office or the International Monetary Fund, provide in-depth analysis of fiscal policies and their economic consequences.

Q: How can I use the 2025 fiscal calendar to make informed business decisions?

A: The 2025 fiscal calendar provides valuable information for businesses to make informed decisions:

- Analyze Government Spending Plans: Identify sectors with potential growth opportunities based on government spending priorities.

- Monitor Tax Policies: Anticipate potential tax changes and adjust pricing strategies, investment plans, and tax planning accordingly.

- Stay Informed about Regulatory Changes: Ensure compliance with evolving regulations to avoid legal issues and potential penalties.

- Develop Contingency Plans: Prepare for potential economic shocks or policy shifts by developing contingency plans for different scenarios.

Tips for Navigating the 2025 Fiscal Calendar

- Stay Informed: Regularly monitor government websites, financial news outlets, and industry resources for updates on fiscal developments.

- Analyze Data: Scrutinize budget documents, spending plans, and tax policy proposals to identify potential trends and impacts.

- Consult Experts: Seek guidance from financial advisors, economists, or industry experts to gain insights into the implications of fiscal policies.

- Develop a Plan: Based on your understanding of the fiscal calendar, develop a plan for your business, investments, or personal finances.

- Be Adaptable: Remain flexible and adaptable to changing circumstances, as fiscal policies can evolve throughout the year.

Conclusion: The Importance of a Comprehensive Understanding

Navigating the 2025 fiscal calendar requires a comprehensive understanding of its key elements, potential impacts, and available resources. By staying informed and actively engaging with this framework, businesses, investors, and individuals can make informed decisions, optimize their strategies, and navigate the complex world of government finances. The fiscal calendar serves as a vital tool for understanding economic trends, shaping financial decisions, and ultimately, contributing to a more stable and prosperous future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Landscape: Understanding the 2025 Fiscal Calendar. We appreciate your attention to our article. See you in our next article!